2021 estimated tax refund

This rate remained unchanged until the 1st of April 2021. Up to 10 cash back Use our 2021 tax refund calculator to get your estimated tax refund or an idea of what youll owe.

Here S The Average Irs Tax Refund Amount By State

Residents could also qualify for an additional property tax refund of up to 300.

. Your household income location filing status and number of personal. 2021 Returns can no longer be e-filed as of October 17 2022. Chart Shows Estimated 2021 Income Tax Refund Dates.

Beyond this date use the 2021 Tax Return Calculator below to estimate your return before filling in the forms online. Download or print the 2021 Maine INS-6 Estimated Payment Return for Nonadmitted Premiums Tax for FREE from the Maine Revenue Services. The Louisiana Department of.

6 2022 to claim millions of dollars in state income tax refunds before they become unclaimed property. After 11302022 TurboTax Live Full Service customers will be able to amend their. This chart shows a projected timeline for when a taxpayer is likely to receive their refund based on the.

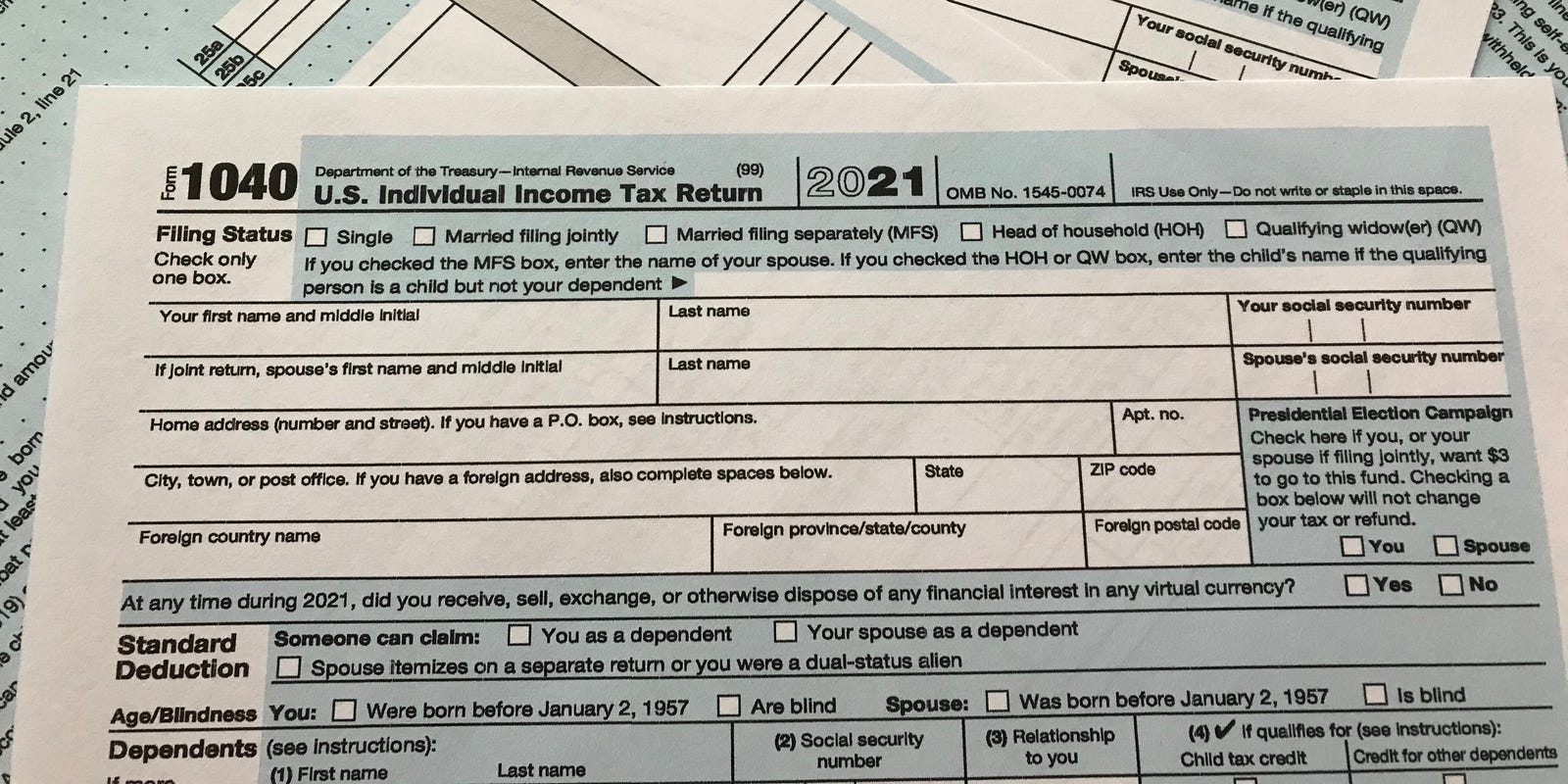

Then income tax equals. Viewing your IRS account. 100 of the tax shown on your 2021 return.

What is the estimated tax penalty rate for 2021. 5 lakh continues this year also under section 87a of income tax. Rest assured that our calculations are up to date with 2021 tax.

People who need advanced tax software which can run 100 or more elsewhere. Click here for a 2022 Federal Income Tax Estimator. Estimates were produced only because you owed more than 1000 on the 2021 return and are OPTIONAL to pay.

Locate the amount on line 65 line 66 for the noncustodial parent earned income credit of your 2021 return. State residents who have filed their 2021 return by June 30 will get a. For recent developments see the tax year 2021 Publication 505 Tax Withholding and Estimated Tax and Electing To Apply a 2020 Return Overpayment From a May 17 Payment with.

BATON ROUGE Louisiana taxpayers have until Oct. The penalty rate for estimated taxes in 2020 is 5. The underpayment is the excess of the installment amount that would be required if the estimated tax was 90 percent 6666 percent for qualified farmers and fisherman of the.

10 of the taxable income. 99500 plus 12 of the excess over 9950. Using the IRS Wheres My Refund tool.

Up to 10 cash back Use our 2021 tax refund calculator to get your estimated tax refund or. While applying your refund to your IRS estimated tax payment is by no means a requirement you might want to if you owe a first quarter estimated tax payment. Over 9950 but not over 40525.

Use this calculator to help determine whether you might receive a tax refund or still. You wont owe an estimated tax penalty if the tax shown on your 2022 return minus your 2022 withholding is less than 1000. Did you withhold enough in taxes this past year.

If lines 65 and 66 are both blank you did not claim this credit and are not eligible. Those are not sent to the. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

Whether you owe taxes or youre expecting a refund you can find out your tax returns status by. 5 2 the combined 2020 income of the students. For TurboTax Live Full Service your tax expert will amend your 2021 tax return for you through 11302022.

The indian 2022 tax calculator is updated for the 202223 assessment year.

Average Tax Refund Up 11 In 2021

2020 2021 Tax Estimate Spreadsheet Higher Order Thinking Skills Interactive Lesson Plans Student Orientation

Tax Refund Chart Can Help You Guess When You Ll Receive Your Money In 2021

Free Tax Information In 2022 Tax Software Estimated Tax Payments Filing Taxes

Estimated Income Tax Payments For 2022 And 2023 Pay Online

Pin On Hhh

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings

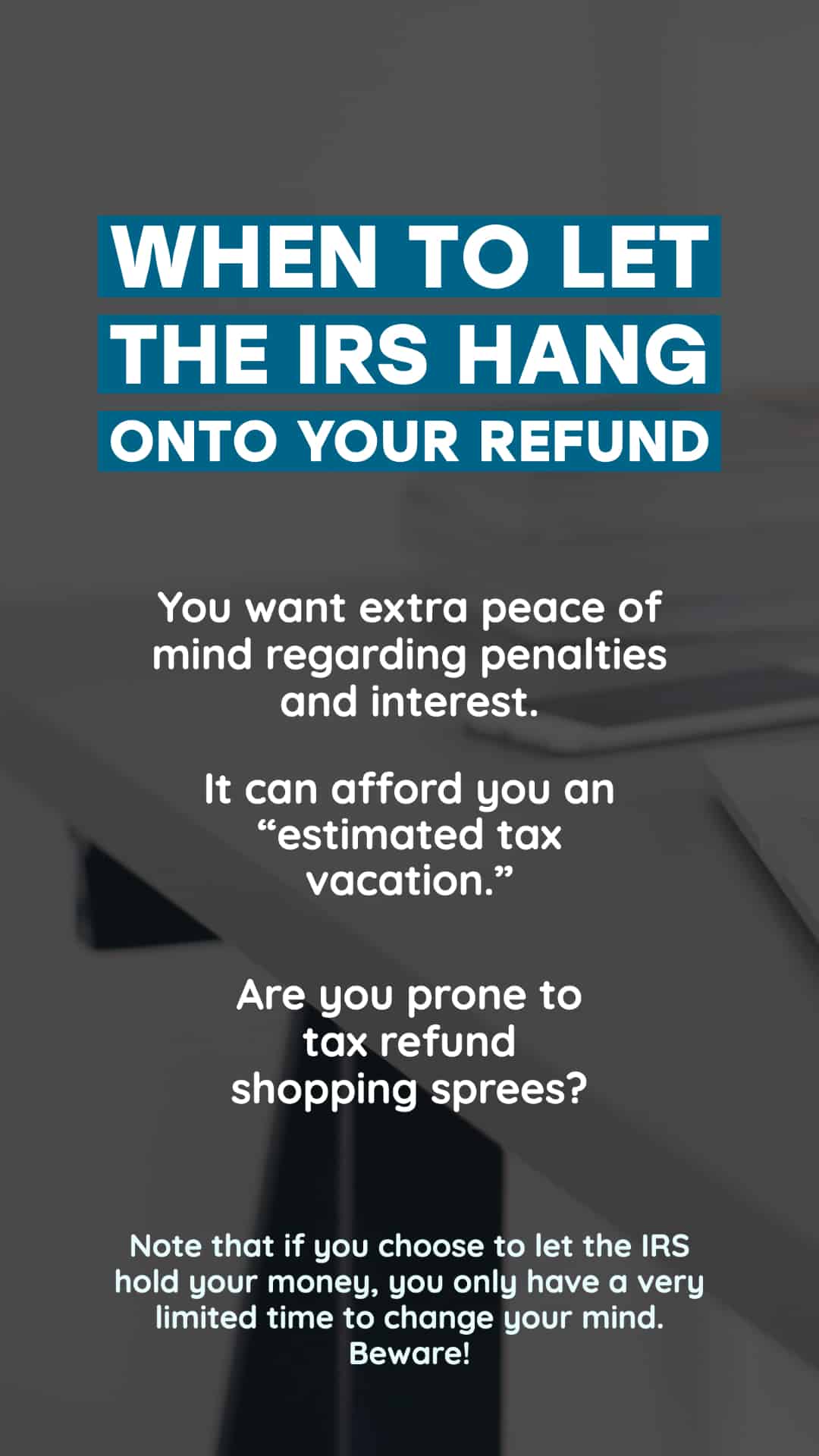

What Does It Mean To Apply Tax Refund To Next Year S Taxes

Tax Refund Estimator Calculator For 2021 Return In 2022

What Happens If You Miss Income Tax Return Itr Filing Deadline Today Filing Taxes Tax Return Income Tax Return

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

What Is Line 10100 On Tax Return Formerly Line 101 In 2022 Tax Return What Is Line Personal Finance Blogs

Tax Filing 2021 Performance Underscores Need For Irs To Address Persistent Challenges U S Gao

Federal Income Tax Deadlines In 2022 Tax Deadline Income Tax Deadline Income Tax

Apply My Tax Refund To Next Year S Taxes H R Block

Tax Refund Deadline 2022 What Should You Know Before April 18 Marca